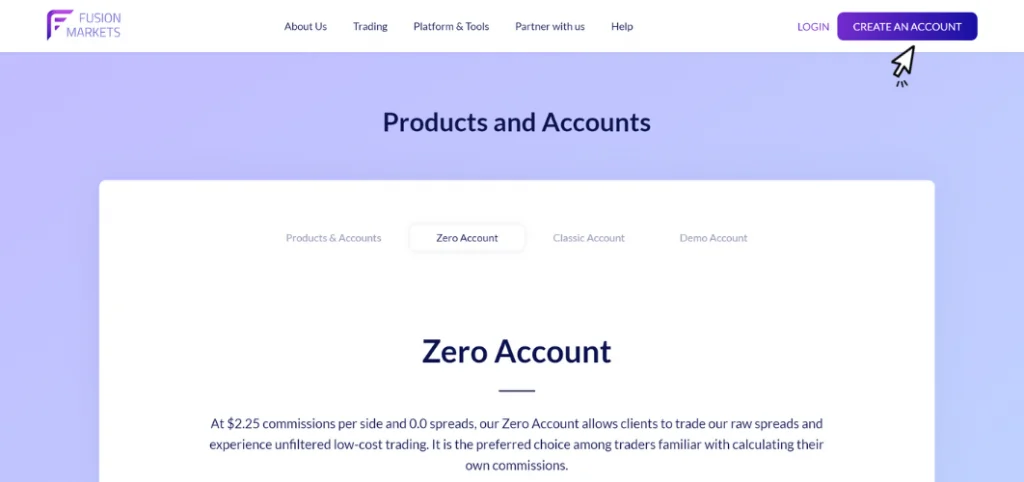

Zero Account Features Overview

Fusion Markets Zero Account delivers institutional-grade trading conditions with raw spreads starting from 0.0 pips. The account structure implements a transparent commission model of $4.50 per standard lot round turn. Traders access over 120 financial instruments through MetaTrader 4 and MetaTrader 5 platforms. The execution system processes orders with an average speed of 0.05 seconds through institutional liquidity providers. Account holders receive access to advanced trading tools and market analysis resources. Multiple trading strategies receive support including scalping and hedging. The platform maintains no minimum deposit requirement for account activation.

Table 1: Zero Account Specifications

| Feature | Details |

| Minimum Spread | 0.0 pips |

| Commission per Lot | $4.50 round turn |

| Minimum Deposit | $0 |

| Maximum Leverage | 1:500 |

| Execution Type | Market execution |

| Trading Platforms | MT4/MT5 |

| Available Instruments | 120+ |

Trading Cost Structure

The Zero Account implements a commission-based pricing model with institutional raw spreads. Commission charges apply at $2.25 per side for standard lot transactions. Trading costs remain transparent with no hidden markup on spread pricing. Volume-based discounts become available for high-volume traders. The pricing structure supports all trading instruments without variation. Commission calculations integrate directly into platform displays. Regular cost analysis ensures competitive pricing maintenance.

Commission Calculation Examples

- Standard lot (100,000 units): $4.50 total

- Mini lot (10,000 units): $0.45 total

- Micro lot (1,000 units): $0.045 total

- Volume discounts: 5-10% for qualified traders

- Multi-asset trading: Uniform commission structure

- Cross-currency pairs: Standard commission applies

- Precious metals: Per lot commission basis

Trading Platform Integration

The Zero Account operates through MetaTrader 4 and MetaTrader 5 platforms with full functionality. Advanced charting capabilities include multiple timeframes and technical indicators. Custom indicator development receives support through platform programming languages. Mobile applications enable trading through iOS and Android devices. WebTrader provides browser-based access without software installation. Real-time market data feeds ensure accurate pricing information. Platform tools support multiple trading strategies.

List of Platform Features:

- Advanced charting tools

- Multiple timeframe analysis

- Custom indicator support

- Expert Advisor compatibility

- Mobile trading access

- One-click trading

- Market depth display

Trading Instruments Access

Zero Account holders gain access to multiple asset classes through a single account. The forex offering includes 90+ currency pairs with institutional pricing. Commodity trading covers precious metals and energy products. Index CFDs provide exposure to global equity markets. Cryptocurrency trading includes major digital currency pairs. Share CFDs enable US stock trading without commissions. Multiple order types accommodate different trading approaches.

Available Trading Categories

- Major forex pairs: EUR/USD, GBP/USD, USD/JPY

- Minor pairs: EUR/GBP, GBP/JPY, EUR/AUD

- Precious metals: XAU/USD, XAG/USD

- Energy: WTI Crude, Brent Oil, Natural Gas

- Global indices: US30, SPX500, UK100

- Cryptocurrencies: BTC/USD, ETH/USD

Execution Technology

Zero Account execution utilizes advanced technology ensuring rapid order processing. Server infrastructure locates in Equinix NY4 data center providing stable connectivity. Multiple liquidity providers ensure competitive pricing and deep market access. Order execution averages 0.05 seconds with minimal slippage. Platform stability maintains through redundant systems and backup power. Technical monitoring ensures consistent performance levels. Regular system updates implement performance improvements.

Table 2: Execution Metrics

| Parameter | Performance |

| Average Speed | 0.05 seconds |

| Server Location | Equinix NY4 |

| Liquidity Providers | 12+ |

| Uptime | 99.9% |

| Slippage | Minimal |

| Requotes | None |

| Backup Systems | Real-time |

Account Management Features

The client portal provides comprehensive account management capabilities. Real-time position monitoring tracks trading activity and results. Multiple funding options support account deposits and withdrawals. Performance analytics generate detailed trading statistics. Document management handles verification requirements efficiently. Security features protect account access and transactions. Support services assist with account queries.

Management Tools

- Position tracking

- Fund management

- Performance analysis

- Document handling

- Security settings

- Support access

- Trading history

Additional Trading Services

Zero Account holders receive access to market analysis and trading resources. Technical analysis tools provide trading opportunity identification. Economic calendar integration tracks market-moving events. Trading signals offer entry and exit suggestions. Educational materials support trading development. Regular webinars cover market analysis topics. Personal account managers assist with trading queries.

List of Trading Resources:

- Technical analysis tools

- Economic calendar

- Trading signals

- Educational materials

- Regular webinars

- Personal support

- Market updates

Security Implementation

The platform implements multiple security layers protecting trading accounts. Two-factor authentication secures account access points. SSL encryption protects data transmission and storage. Segregated accounts maintain fund separation at major banks. Regular security audits verify protection measures. Automated monitoring detects suspicious activities. Recovery procedures protect against account compromise.

FAQ:

The Zero Account provides raw spreads from 0.0 pips with a fixed commission structure, making it cost-effective for high-volume traders and those requiring transparent pricing.

No restrictions apply to trading strategies – the account supports scalping, hedging, automated trading, and all other legitimate trading approaches with market execution.

Commissions calculate proportionally to trade size – standard lots incur $4.50 round turn, with mini and micro lots charged proportionally lower amounts. Volume discounts apply for qualified traders.